Closing the Black Homeownership Gap

Did you know: Milwaukee has the second-largest homeownership gap between Black families and White families in the nation? The current 43% difference is larger than it was in 1968, when housing discrimination was legal.

And while housing discrimination is technically no longer legal, unfair policies and outright discrimination in the years since the Fair Housing Act made it unconstitutional and have contributed to this glaring inequality.

“According to 2020 data from the Home Mortgage Disclosure Act, lenders deny mortgages for Black applicants at a rate 80% higher than that of White applicants.” (CNBC)

In a recent blog post, the Urban Institute took what they learned from a Housing Finance Policy Center data talk and packaged it in a way that neatly explains the unique depths of this crisis, including how the Great Recession impacted homeownership recovery numbers, the role education plays in lending, and how “17% of the Black-White homeownership gap can’t be explained by identifiable factors.”

Ending the Black homeownership gap in Milwaukee and beyond will require serious change at an institutional level. In the meantime, Acts Housing (along with Acts Lending and various traditional lending partners) is dedicated to and focused on increasing African American homeownership. Last year, of the 181 families who became Acts homeowners, 60 were Black families.

Exponential Growth

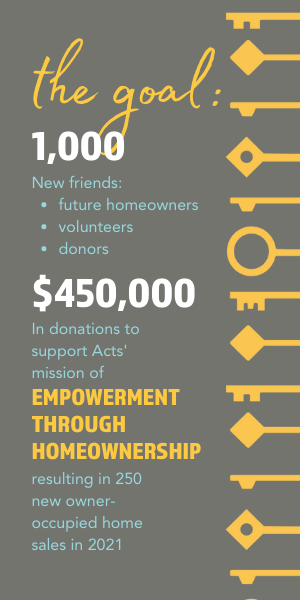

Our goal for 2021 and beyond is to exponentially increase that number, helping African-American families achieve homeownership and all of the stability, civic engagement, and, and generational financial security that comes with it.

Help close the Black Homeownership Gap. Learn more about how you can contribute to Longest Neighborhood Table 2021.Table today.

MolsonCoors is Doubling Your Donation!

Donate any amount to support Acts Housing, and MolsonCoors will match your donation (up to $2,000 total)